Credit Officer Test

The Credit Officer Online Test is a standardized assessment designed to evaluate the skills and knowledge required for individuals seeking to work as credit officers in financial institutions. This test typically measures a candidate’s understanding of credit analysis, risk management, financial statements, and loan processing. It also assesses their ability to make informed lending decisions, ensuring they can evaluate the creditworthiness of borrowers. The test is used by banks, lending firms, and other financial institutions to streamline their hiring process, ensuring that only qualified candidates with the necessary analytical and decision-making skills are selected for the role. It helps to identify individuals who can effectively manage credit risk and contribute to the institution’s financial stability. Ensure your hiring process is streamlined and efficient – hire a skilled Credit Officer today!

About the Credit Officer Test

Are you in need of skilled Credit Officers to manage financial risks and assess creditworthiness? Look no further than Xobin’s Credit Officer Test. In the fast-paced world of finance, finding the right candidate with the expertise to make sound credit decisions is crucial. Xobin offers a specialized assessment tool designed to evaluate the competency of Credit Officers, ensuring that your business hires the best talent for the job.

Covered skills

Financial analysis

Credit risk assessment

Loan underwriting

Regulatory compliance

Enhance your hiring process with Xobin’s Credit Officer Test to ensure a skilled workforce. Our assessment follows EEOC guidelines, promoting fairness and diversity in evaluating candidates for credit officer roles.

Organizations Served

Availability: Ready to use and customizable

Questions Type :Scenario-based MCQ questions

Time: 30-45 minutes

Level: Flexible and customizable

Related Job Roles to Use the Credit Officer Test

Given the diverse nature of Credit Officer roles within the banking sector, job titles may vary across different organizations. We have compiled a range of related job positions that require similar skills, duties, and goals as Credit Officers. Xobin’s Credit Officer Test is a valuable tool for evaluating competency in any of these related job roles within the banking industry, ensuring a comprehensive assessment.

Credit Analyst

Loan Officer

Collections Specialist

Credit Risk Manager

Credit Underwriter

Credit Administrator

Why Choose Xobin for the Credit Officer Test?

Our Credit Officer Test incorporates generative AI technology, allowing companies to assess candidates efficiently and make informed decisions with advanced reports, streamlining the hiring process significantly.

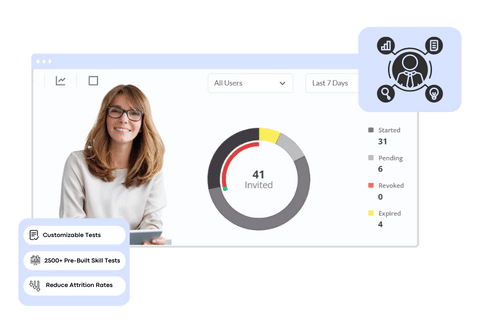

Comprehensive Skill Assessment

Xobin offers a wide range of customizable skill assessment tests specifically designed for credit officers. These tests cover various aspects of the role, ensuring that candidates are thoroughly evaluated for their suitability for the position.

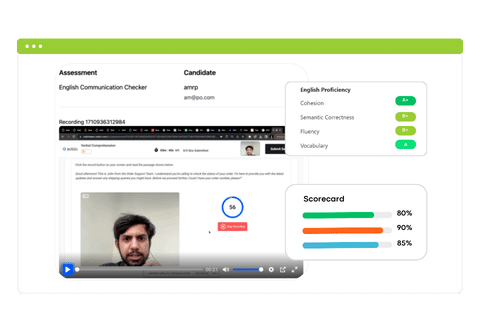

AI-Driven Communication Checker

Xobin’s AI-driven communication checker tool is a valuable asset for evaluating the communication skills of Credit Officer candidates. This feature ensures that you can assess candidates’ ability to effectively communicate in a professional setting, a crucial skill for executive assistant roles.

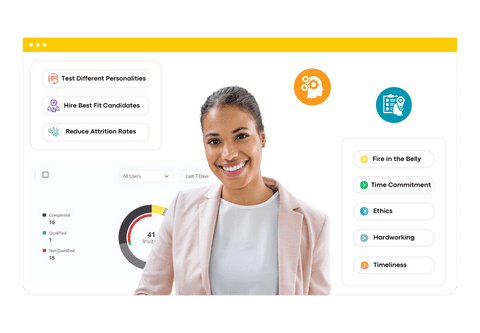

Psychometric Testing

Xobin offers a wide range of customizable skill assessment tests specifically designed for credit officers. These tests cover various aspects of the role, ensuring that candidates are thoroughly evaluated for their suitability for the position.

AI-Based Web Proctoring

Ensuring the integrity of the credit officer test is essential, and Xobin’s AI-based web proctoring feature helps monitor candidates during the assessment. This technology detects any suspicious behavior, ensuring a fair evaluation process.

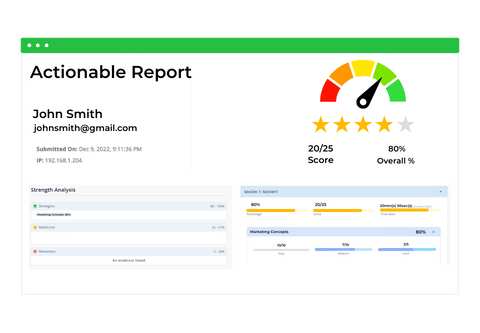

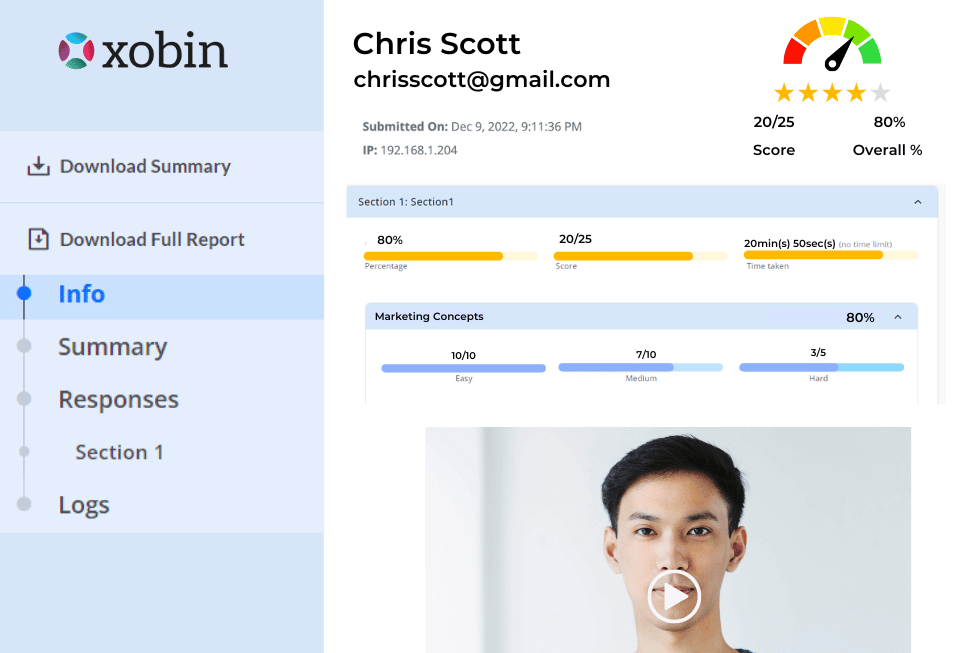

Actionable Reports

Xobin’s Skill Assessment Software generates detailed and actionable reports for credit officer candidates. These reports provide a 360-degree view of candidates’ abilities and skills, enabling you to make informed hiring decisions based on data-driven insights.

How Does Xobin’s Assessment Test Works?

From Test Creation to Candidate Evaluation. The Xobin’s Credit Officer Test facilitates Recruiters and Hiring Managers through the complete assessment process.

Add the Test

Firstly, choose from our Library of job-specific Pre-built tests. You can customize your own test too.

Invite Test takers

Firstly, choose from our Library of job-specific Pre-built tests. You can customize your own test too.

Testing Begins

Sit back while candidates take the online test. AI Proctoring features prevent candidates from cheating.

1-Click Shortlist

Lastly, shortlist the top candidates with ease by using auto-generated scores and advanced reports.

How Xobin Prevents Cheating?

Xobin utilizes AI-based web proctoring, eye movement monitoring, browser activity tracking, ChatGPT protection, plagiarism detection, non-Googleable questions, user authentication, and copy-paste prevention to ensure a secure and fair Credit Officer Test environment.

AI-Based Web Proctoring

Xobin tracks candidates during the Credit Officer Test through video proctoring and browser monitoring to detect any suspicious behavior.

EyeGazer Based Proctoring

Xobin uses EyeGazer technology to monitor candidates’ eye movements, ensuring they remain focused and adhere to exam rules for a secure assessment.

Browser Activity Monitoring

Xobin’s Browser Activity Monitoring feature tracks all browser activities to maintain test integrity and guarantee a fair evaluation for the Credit Officer Test.

ChatGPT Protection

Xobin implements ChatGPT protection to prevent candidates from seeking outside help or cheating during the Credit Officer Test.

Plagiarism Detection

Xobin’s software includes plagiarism detection to identify any copied content or cheating attempts by candidates.

Non-Googleable Questions

Xobin ensures that the Credit Officer Test questions are not easily searchable on Google, preventing candidates from finding answers online.

User Authentication

Xobin verifies the identity of candidates taking the Credit Officer Test to ensure that only authorized individuals are participating.

Copy Paste Prevention

Xobin’s software prevents candidates from copying and pasting answers during the Credit Officer Test, reducing the risk of cheating and ensuring a fair evaluation process.

Why Choose the Credit Officer Test?

Customize Test

Pick a ready to-go test or combine it with other skills. Additionally, you can customize the test by picking from our library with over 100,00+ questions.

Candidate Friendly

We don’t complicate the process for candidates. No downloading lockdown browsers, No gimmicky games or impersonal chat.

Validated and Complaint

This test was crafted by a group of industry professional and subject matter experts. Thereafter, the internal test controllers.

Enhance Decision-Making with Xobin’s Credit Officer Test Detailed and Advanced Reports

Enhance your hiring process with the top Credit Officer Test in the industry. Utilize Xobin’s advanced assessment to identify the perfect candidates with detailed reports, making hiring 20x faster and more efficient. Let’s simplify the hiring process for you!

Who Can Use Xobin’s Credit Officer Test ?

Xobin’s Credit Officer Test is specifically designed for businesses in the financial industry, including banks, credit unions, and lending institutions. Whether you’re looking to hire credit officers, loan officers, or financial analysts, this test is the perfect solution for evaluating candidates’ credit analysis skills and financial acumen.

If the test is used for pre-employment screening and job evaluation, the primary users typically include members of the HR team, talent acquisition specialists, or company recruiters. These professionals administer the credit officer assessment to identify candidates who possess the necessary skills and knowledge for the role. Candidates who perform well on this test are considered suitable for credit officer positions. Hiring managers can also use the test reports to assess candidates’ abilities before scheduling interviews.

In the case of skill gap analysis, the primary users would be from the Learning and Development (L&D) team. Learning and Development administrators and managers can use this test to identify skill gaps and training needs within their organization. The detailed reports and analytics provided by the test can help create tailored training programs to enhance the skills of credit officers and other financial professionals.

Xobin’s Credit Officer Test is a versatile tool that can benefit a wide range of users involved in the recruitment process. It offers an effective way to evaluate candidates’ capabilities and select the most qualified individuals for credit officer roles.

Looking for Other Hiring Solutions?

Skill Based Assessments

This Branding Strategy skills test evaluates candidates’ ability to define, position, manage, and develop a brand.

Job Role Assessments

This Branding Strategy skills test evaluates candidates’ ability to define, position, manage, and develop a brand.

Interview Scheduling

This Branding Strategy skills test evaluates candidates’ ability to define, position, manage, and develop a brand.

Video Based Assessments

This Branding Strategy skills test evaluates candidates’ ability to define, position, manage, and develop a brand.

4.7/5 on G2

4.7/5 on G2

What Clients Say about Xobin

Xobin platform worked well for campus hiring. Great support by the team. Moreover, they are always ready to understand the issue and provide a comprehensive solution.

Alex Acker

Senior Manager

We now have a far better understanding of the candidate’s potential for product development because of Xobin. It was simple to use and offered a huge selection of assessments.

David Shackelford

Project Manager

Xobin is ideal for organisations of any size. Xobin manages all aspects of screening using their Xoforms and Assessments. They have sophisticated tools, such as the Xoforms.

Spencer Mann

VP of Growth

Use Xobin to hire top talents 20x faster and bias-free

Our skill assessment tests identify the best candidates for your organization and make your hiring decisions 20x faster, easier, and bias-free.

Frequently Asked Questions

How does Xobin ensure the security and confidentiality of test data for the Credit Officer Test?

Xobin has different data confidentiality certificates and GDPR Certificate, and follows all data security guidelines to ensure the security and confidentiality of test data for the Credit Officer Test.

Can Xobin’s Skill Assessment Software be used for hiring Credit Officers in the finance industry?

Yes, Xobin’s Skill Assessment Software can be used for hiring Credit Officers in the finance industry, as it is suitable for hiring in various industries including finance.

How does Xobin’s AI-Based Web Proctoring feature benefit the Credit Officer Test?

Xobin’s AI-Based Web Proctoring feature tracks candidates during the exam through video proctoring and browser monitoring, capturing any unusual activity for test admins to view, ensuring exam integrity for the Credit Officer Test.

What is EyeGazer Based Proctoring and how does it enhance the integrity of the Credit Officer Test?

EyeGazer Based Proctoring tracks candidates’ eye movements during the exam, ensuring they stay focused and comply with exam rules, enhancing the integrity of the Credit Officer Test.

How does Xobin prevent plagiarism and ensure the authenticity of responses in the Credit Officer Test?

Xobin uses ChatGPT protection, plagiarism detection, non-googleable questions, and copy-paste prevention features to prevent plagiarism and ensure the authenticity of responses in the Credit Officer Test.

How does Question Randomization feature in Xobin’s Skill Assessment Software benefit the Credit Officer Test?

Xobin’s Question Randomization feature provides every candidate with a unique set of questions, ensuring a diverse testing experience for the Credit Officer Test.